Postmates’ founder quits right after Uber’s acquisition, others made millions after layoff packages

Last June Uber saw their efforts of buying food delivery company Grubhub collapsing. Dutch rival JustEat Takeaway.com agreed to buy Grubhub by $7.3Billion.

Uber didn’t stop looking around and in November Uber acquired food delivery app Postmates.com for $2.65Billion. Postmates was the 4th biggest food delivery services in the US, right behind Grubhub.

Uber’s plan is to merge Postmates technology with Uber’s technology, having only just one infrastructure. Uber didn’t comment on more details about this integration and if they are planning to keep the Postmates brand for the long term. For now, Postmates brand and app are still separate to Uber.

Now, less than three months after Uber’s acquisition, Bastian Lehmann, Postmates founder, decides to leave the company. At the same time another 15% of Postmates’s staff were laid off, some of them with a couple of millions dollars exit packages.

And it seems Uber is not stopping with these layoffs, with more to come in the following months.

This is not the first time two of he biggest players in US join forces, in 2013 GrubHub merged with Seamless which still has its own brand and service separated from Grubhub.

Before the acquisition, Postmates market share in the US was dropping from 12% in 2019 to 8% in 2020.

Postmates are in all the 50 states however they have a small presence in each state. Only 350 cities in total. Grubhub which is also in all US states has their services available in more than 5500 cities.

In terms of consumer option, Grubhub has more than five times available restaurants than Postmates. All of these factors explain why Postmates was a second option to Uber’s plan.

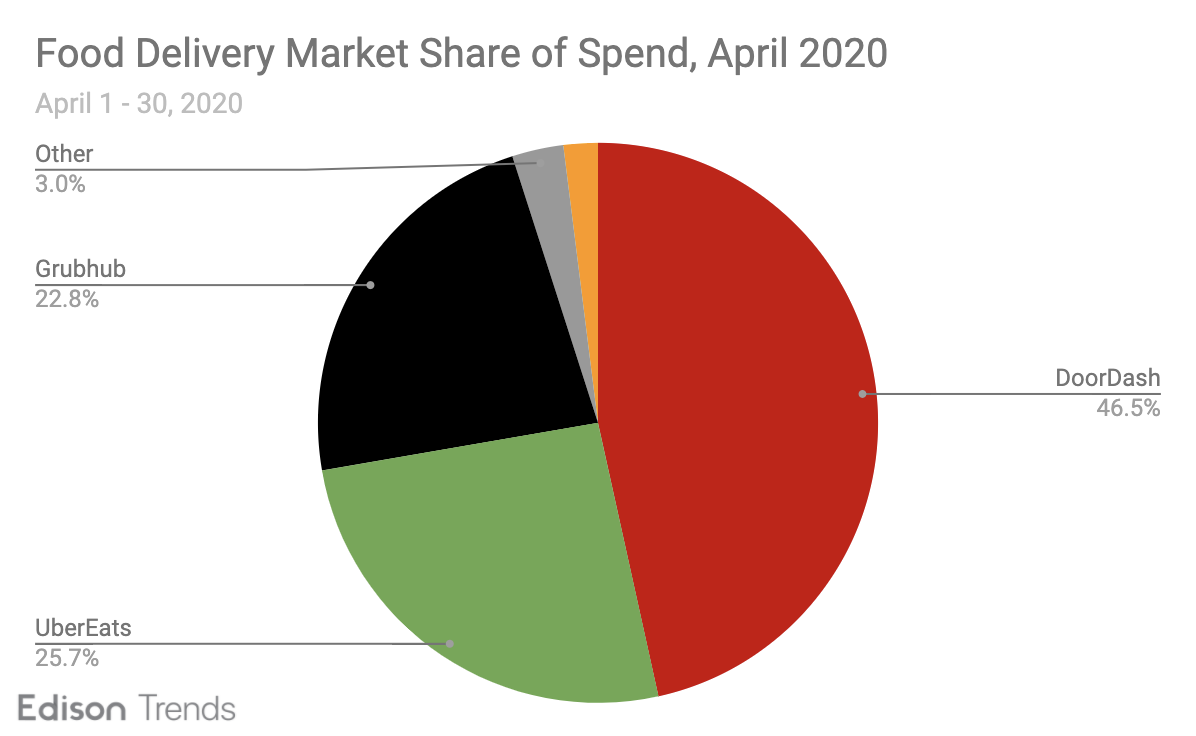

Doordash, which is seeing a strong demand and growth, keeps the title as the biggest food online service in the US with more than 40% of the market share.

However, in January 2021, UberEats+Postmates have more market share than Grubhub (30% vs 20%) which keeps loosing market share since the Grubhub IPO.

On top of the layoffs, fewer competition in the market creates a worst scenario for restaurants and consumers. Restaurants are fighting and complaining about the high fees the food delivery services charge them. For consumers, the less competition exists the more power the brand has to control prices and delivery costs.

It will be interesting to see what the pandemic and the high growth in demand for food delivery services will bring in 2021. Is more consolidation on the radar?